Keep Calm And Stay Invested

No one has a crystal ball, but this has been the general consensus and advice we have given to clients over the years. Every client has differing circumstances, particular age (pension phase) and will need to manage client’s needs individually.

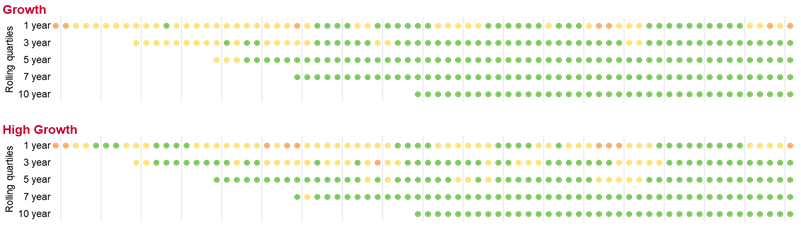

Below are some examples from Vanguard which are worth reviewing.

UNDERSTANDING MARKET DOWNTURNS

Nearly everywhere you turn, from friends and colleagues to news channels, you can find someone with a strong opinion about the financial markets. At the moment, it seems that the news on so many fronts is bad with skyrocketing energy costs and both equity and bond markets down significantly since the start of the calendar year.

While investing in the stock market is typically a prudent choice for investors seeking long-term growth, sharp drops can still be hard to stomach. Below are some things to keep in mind if a market tumble makes you feel the need to “do something” which might shut you out of the strong recoveries that have historically followed market downturns.

Downturns aren’t rare events

Typical investors, in all markets, will endure many of them during their lifetime.

There has been a lot of focus on the transition to a bear market (with the line in the sand of a 20% decline having been triggered by the US S&P 500 index in mid-June 2022). This is the same market that delivered returns of 36% for the year ended December 2021, and even with a 20% decline at the onset of the Covid pandemic, recorded 7.3% for the year ended December 2020. It is important to keep in context that in spite of several bear markets, the market has also continued to trend higher over the long term. Not all financial market declines are the same in length or severity. For example, historically speaking, the GFC of 2008-2009 was an extreme anomaly. As challenging as that event was, it was followed by one the longest stock market recoveries in history.

The Australian equity market (which admittedly recorded a more modest, but still very respectable 17.5% for the year ended December 2021), has held up relatively well, posting a decline of 11% (so not yet in bear territory).

Dramatic market losses can sting, but it’s important to keep a long-term perspective and stay invested in order to participate in the recoveries that typically follow.

Some bear markets since 1980 have been sharp, but many bull market surges have been even more dramatic, and often longer, leaving stock investors well compensated over the long term for the risk they took on.

But such action would shut you out of the strong recoveries that have historically followed market downturns. The answer is to come up with a game plan before the next market pullback so you’re well-positioned to try to take advantage of the opportunities that follow. What’s more, you’ll probably know what to expect as markets cycle through their phases, so you can tune out messages that don’t help your strategy.

TIMING THE MARKET IS FUTILE

The best and worst trading days often happen close together and occur irrespective of the overall market performance for the year.

As the random pattern of returns below highlights, predicting which segments of the markets will do well is also a tough order. Broad diversification keeps you from having too much exposure to the worst-performing areas of the market in the event of a downturn.

The power of diversification

Total returns (%) for the major asset classes for financial years ending between 1992 and 2021.

The illustration below shows the performance of various asset classes over the past 30 years ranked from worst to best. When deciding where to invest, it is important for investors understand that the best and worst-performing asset classes will o‑en vary from one year to the next. Having a diversified mix of investments across multiple asset classes can help smooth out returns over time.

The illustration also reinforces the importance of sticking to an investment strategy and focusing on the long term.

Source: Andex Charts Pty Ltd June 2021. Notes: 1. MSCI World ex-Australia Net Total Return Index (Local Currency) - represents a continuously hedged portfolio without any impact from foreign exchange fluctuations. 2. Index prior to 30 June 2008 is the Citigroup World Government Bond Index AUD Hedged, from 30 June 2008 the index is the Bloomberg Barclays Global Treasury Index in AUD (Hedged). 3. Prior to 1 May 2013, index is the UBS Global Real Estate Investors Index ex-Australia with net dividends reinvested. From May 2013 the index is the FTSE EPRA/NAREIT Developed ex-Australia Rental Index with net dividends reinvested. Vanguard Investments Australia Ltd (ABN 72 072 881 086 / AFS Licence 227263) is the product issuer. We have not taken your circumstances into account when preparing the information so it may not be applicable to your circumstances. You should consider your circumstances and our Product Disclosure Statements (“PDSs”) before making any investment decision. You can access our PDSs at vanguard.com.au or by calling 1300 655 101. Past performance is not an indicator of future performance. ADVSTCBBMA_072021

THE BEST DEFENCE: MAKING A PLAN AND STICKING TO IT

By focusing on the factors of your investing strategy we can control (including things such as asset allocation and costs) and not worrying about those things out of our control, such as downturns in the markets and economy, you can prepare your portfolio for the financial market shocks.

Remember that bearish market conditions—while inevitable—don’t last forever. As a savvy investor, you can ignore short-term pullbacks of the market (and any commentary that might cause you to veer off course) and remain committed to achieving your long-term vision.

Downturns come and go. The results of a well-designed and faithfully followed plan, on the other hand, can serve you the rest of your life.

DISCLAIMER

The information produced in this email is the property of Vanguard Investments Australia Ltd (ABN 72 072 881 086 / AFS Licence 227263). Vanguard Investments Australia Ltd is the product issuer. Vanguard has not taken anybody's circumstances into account when preparing the information in this email so it may not be applicable to your circumstances or those of any other person.

GENERAL ADVICE WARNING

The advice contained within this document does not consider any person’s particular objectives, needs or financial situation. Before making a decision regarding the acquisition or disposal of a Financial Product, persons should assess whether the advice is appropriate to their objectives, needs or financial situation. Persons may wish to make their assessment themselves or seek the help of an adviser. No responsibility is taken for persons acting on the information within this document. Persons doing so, do so at their own risk. Before acquiring a financial product, a person should obtain a Product Disclosure Statement (PDS) relating to that product and consider the contents of the PDS before making a decision about whether to acquire the product.