Monthly Investment Update — July 2022

The 2021-2022 financial year was a tough one for stock market investors with most major global indices declining.

This month’s newsletter looks at some of the key events that have shaped markets over the past 12 months and what the future may look like.

The main points are as follows:

The past financial year has been a year of two contrasting halves.

The first half started well as markets believed the Fed’s ‘transitory’ (temporary) inflation narrative.

However the expectation for a path of gradually higher interest rates was challenged as inflation accelerated.

By late 2021 equity markets had peaked and by early 2022 an aggressively higher interest rate hiking commenced

Over the balance of 2022 the US Fed looks set to continue to raise interest rates aggressively to slow inflation.

The market view today is for interest rates to peak by Dec22 and to decline in 2023 as the economy slows.

In focus will be the monthly inflation data, the health of US labour market, and corporate profits.

We remain cautious whilst we eagerly await the reporting season about to get underway.

With another financial year behind us, now is a good time to reflect on the key events of the last 12-months. In summary, Central Banks changed course, the market followed, and we had a year of two halves.

The old saying “Don’t fight the Fed” once again proved to be true. The US Federal Reserve Bank (the US Fed) initially thought inflation to be transitory. This view allowed the US Fed and many other Central Banks including Australia’s RBA to keep interest rates at record low levels.

In November inflation accelerated and Central Banks were forced to reassess their views. The US Fed changed course flagging the need to respond to higher inflation. By the end of December, interest rate markets were telling investors to expect higher interest rates in 2022. As expected, equity markets soon started weakening.

In January equity markets expected interest rates to gradually move higher. In February investors erased the word “gradually” as inflation accelerated. By April investors inserted a new word, “aggressively”. Equity markets expected interest rates to aggressively move higher. Let’s be reminded, the weight on asset prices is interest rates.

Where are we today? Expectations are for Central Banks to hike interest rates repeatedly into year end. This is likely to see inflation move materially lower in the next 6 months. Analysts expect corporate profits to remain resilient and grow in the second half of this year. We don’t fully agree with the expectation around corporate profits.

Where to from here remains the key question. We know markets are focussed on where we are in 6-9 months from now. Markets are expecting interest rates to have peaked and to be moving lower. Expectations are for inflation to be much lower. Markets are however still grappling with what economic growth looks like in 2023. Recession?

Right now, Central Banks are taking the view that a recession can be avoided. Fighting inflation is their top priority. The cost of inflation and the cost of fighting inflation will be revealed in the next 6 months. How will Central Banks respond to data over the next 6 months? We will be paying close attention and be sure to not fight the Fed.

The Market Is Not Happy

This could have been avoided!

We are officially in a bear market when looking at the US S&P 500 Index. The market peaked at 4,796 on 3Jan22 and we closed at 3,674 on 16Jun22 (-23.4% decline).

It did not have be this way but unfortunately it is. Much of the pain is due to a policy error from Central Banks.

The world is facing an inflation problem not seen in decades.

Fixing the problem is not going to be easy. In the words of Jerome Powell, “getting inflation down will cause some pain”. Yes, that pain includes a bear market in equities.

Risky assets which include Bitcoin have been crushed. Conservative investments are also down but not as much.

A Quick Recap – The costly mistake!

As regularly discussed in this newsletter, the problem the US Fed finds itself in today is because it has underestimated inflation.

For most of 2021, it labelled inflation as ‘transitory’ (temporary) expecting it to recede as the economy normalised in the aftermath of the pandemic.

The Fed changed tact in Nov21 and has been on a mission to regain credibility ever since and get inflation back under control.

Interest rate expectations have skyrocketed. (Central Banks use interest rates to counteract inflation. Higher interest rates reduce demand and in turn ease price pressures)

Interest Rates Have Been Moving Higher

The US Fed commenced its rate hiking cycle in March with a 0.25% hike and followed this up with a 0.50% increase in May and 0.75% in June.

Financial markets are currently expecting US cash rates to reach 3.75% by year end (from 0.10% at the start of the year). The concern is the Fed will need to go harder in the short term to hit inflation on the head.

Looking into 2023, financial markets are expecting the US Fed to cut interest rates back to 3.00%. Many commentators remain sceptical whether the US Fed get interest rates to 3.75%.

Whilst it Seems Simple, it is VERY Complex

Just how high can rates go? If we look at US, there is a clear trend of lower peak rates over time. This is likely because of more debt in the system over time and a higher sensitivity to rate increases.

This time we think a peak of 3.5% to 4.0% is possible. A stretch, but possible. These higher interest rates will cause significant stress in debt markets which are now much larger than in previous years.

Much higher interest rates have us concerned about the earnings outlook for US corporates in coming quarters.

Consumers Not Feeling Good.

In March we wrote “Consumer confidence is an important part of the US economic puzzle as the US is a consumption driven economy...”

A quick recap of the Michigan Consumer Confidence Survey. “This is a telephone interview with about 500 US families. 60% of them are new survey respondents and 40% are previous respondents”.

Like the 1980’s, consumers are concerned about inflation. More specifically fuel prices.

Like we have argued before, the challenge for Central Banks is this. Do Central Banks solve the inflation problem on Main Street OR do they save asset prices on Wall Street?

The US Fed made a mistake and that needs to be fixed. If that means the consumer will need to spend less and corporate profits need to decline, that is unfortunately the price that needs to be paid.

Is the Consumer Strong Enough to Avoid a Recession?

The US Fed thinks they can engineer an economic soft landing. That is slow the economy/consumer demand without causing a recession.

Backing the US Fed view are equity market bulls who are hopeful that a “strong” consumer balance sheet could save the economy and equity markets.

Consumers may well draw down on excess savings resulting in modest economic growth. If that is the case this is just a mid-cycle slowdown. (Equities are a hold)

The bears however are more focussed on tight household budgets. A concerned consumer may soon be saving more and taking on less debt. (Equities are a sell).

Nobody knows with certainty how the consumer will respond. What we do know is inflation concerns is something new for many younger households. The response may be slow, but they will respond.

Australian Equities

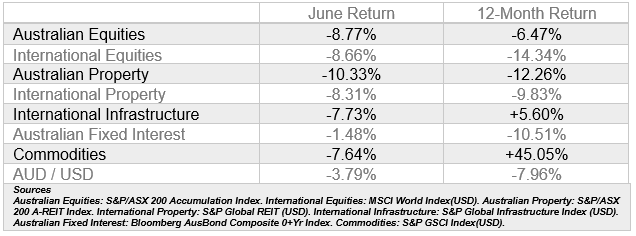

The S&P/ASX200 Index declined -8.77% over the month of June. The weakness in commodity prices providing the catalyst for weakness in the local market.

The Materials sector was the worst performing sector posting a -14.44% decline for the month. The +0.50% RBA rate hike increased the pressure on local banks with the Financials sector weakening -11.87%.

The only sector to end the month in the green was the Consumer Staples sector gaining +0.21%.

International equities

The MSCI All World Index ended the month -8.66% weaker. Recession risk remains a key concern for investors with the added challenges of energy supply in Europe.

Europe led the weakness with the S&P Europe350 Index weaking -9.94%. The US S&P500 Index weakened -8.25% and the S&P Japan500 Index weakened -8.21%.

Emerging markets outperformed developed markets ending the month -5.65% weaker. A rebound in the Chinese market saw the S&P China500 Index gain +8.37% over the month.

Property and Infrastructure

Australian Property Index continued its weak performance ending the month -10.33% lower. The weakness was broad across the sector.

Global Listed Property (Hedged) performed marginally better but still weakened -8.31% over the month.

Global Listed Infrastructure (Hedged) once again outperformed the property sector despite weakening -7.73% over the month.

Fixed income

The Bloomberg Australian Bond Index posted a -1.48% return for the month. This sees the widely followed Australian bond index down double digits over the past 12-months (-10.51%).

The 10-year Australian government bond yield closed the month at +3.69% compared to +1.50% a year ago.

GENERAL ADVICE WARNING

The advice contained within this document does not consider any person’s particular objectives, needs or financial situation. Before making a decision regarding the acquisition or disposal of a Financial Product, persons should assess whether the advice is appropriate to their objectives, needs or financial situation. Persons may wish to make their assessment themselves or seek the help of an adviser. No responsibility is taken for persons acting on the information within this document. Persons doing so, do so at their own risk. Before acquiring a financial product, a person should obtain a Product Disclosure Statement (PDS) relating to that product and consider the contents of the PDS before making a decision about whether to acquire the product.