Monthly Investment Update — March 2023

MARCH 2023

This month’s newsletter looks at some of the key issues facing markets and recent asset class performance.

The main points are as follows:

Higher than expected US inflation data and a resilient US economy is likely to lead to more interest rate hikes.

This comes when the impact of 2022 rate hikes are not yet known, further complicating earnings estimates.

Investor sentiment has however improved since the Oct 22 market lows. Can it last?

With several unanswered questions and equity markets priced for a positive outcome, the investment environment is likely to remain challenging in 2023.

We favour defensive fixed income investments over higher-risk equity investments while we await further economic information.

After a promising start to the year, February saw equity markets run out of steam. Like last year, investors were once again scared off by inflation data which came in hotter than expected.

The elevated January US inflation print is challenging the idea that the US Fed is close to the end of the current interest rate hiking cycle. Investors are now thinking interest rates may go even higher and stay elevated for even longer. Supporting this view is still strong US economic data and a resilient US labour market.

Current expectations are for the US Fed to raise interest rates by 0.25% at each of their next 3 meetings. The story is similar for the Reserve Bank of Australia. This will see US interest rates peak at 5.25% and Australian interest rates peak at 4.10% toward the middle of this year.

We are however yet to know the full economic impact of the 2022 interest rate hikes on economies. We think investors are taking the optimistic view and discounting the lagged impact of the rapid interest rate hiking cycle of 2022.

The question we are asking is, what do corporate earnings looks like as we travel through 2023? We are not overly optimistic. The latest US reporting season missed already lowered Wall Street expectations. This is something that does not happen often, and therefore worth keeping an eye on.

The risk/reward payoff on offer in equity markets is not attractive. Equity market pricing remains elevated whilst future earnings expectations are weakening. Will future earnings expectations soon improve, or will the earnings downgrades accelerate as the impact of rate hikes become more evident? The answer to this question will be known in the coming months.

Today investors are once again being rewarded for investing in defensive fixed income products. Taking advantage of current high-income yields will add to future portfolio returns. We are confident equities will also deliver a similar outcome in time, but a more cautious and patient approach is required today.

Compared to October 2022 – Things have improved – What has changed?

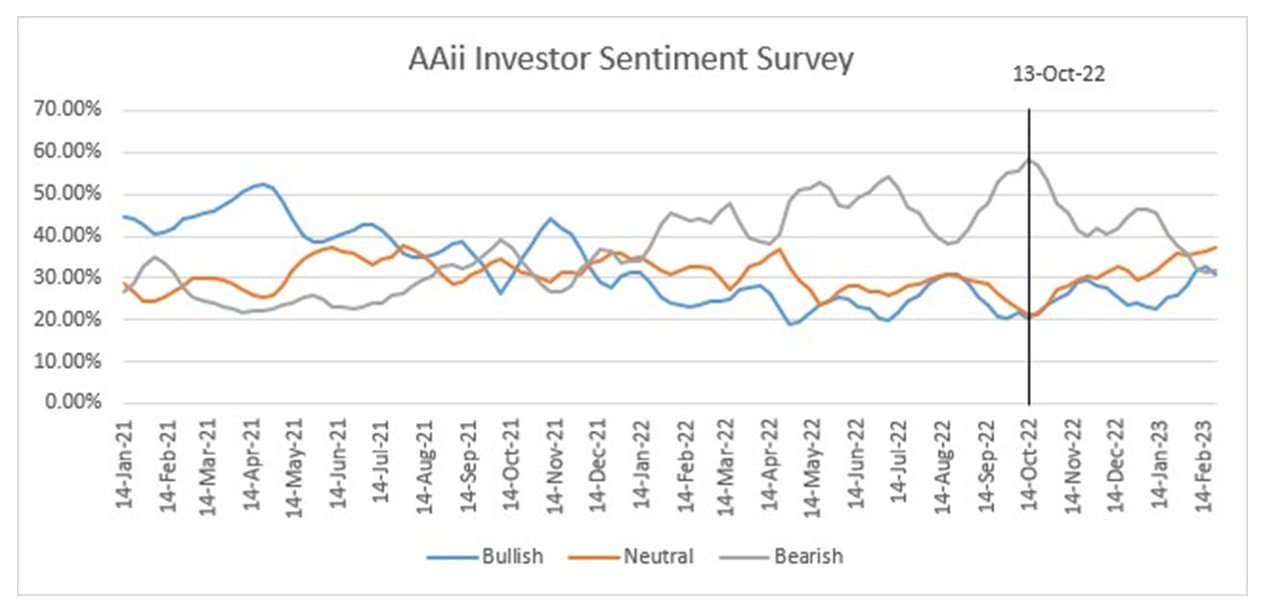

THE OVERLY BEARISH SENTIMENT HAS MODERATED

Improved sentiment amongst equity market investors has seen the US S&P500 Index trade as high as +17% above its mid-October lows.

Investors are not necessarily turning bullish today, at least not to the extent we saw bullish sentiment in the first half of 2021.

The October 2022 market lows coincided with low levels of bullish and neutral sentiment and high levels of bearish sentiment amongst investors surveyed.

Since then, the most notable shift has been a decline in bearish sentiment with a greater uptick in neutral sentiment than bullish sentiment.

Perhaps investors are not yet excited about the future, just not as concerned as a few months ago.

What were investors concerned about 3-6 months ago?

Sticky and elevated inflation with an aggressive rate hiking cycle in the face of a slowing economy.

Let’s see how each of these concerns have changed in recent months.

THE INFLATION OUTLOOK HAS IMPROVED

The inflation basket can broadly be broken down into 4 areas. Volatile Food and Energy, Goods, Housing, and Services excluding housing.

Investors have broadly adopted the view that US goods inflation is under control and the US Fed has taken a similar view.

Services inflation however remains elevated. What is different is the willingness of the US Fed to be patient and let already higher interest rates cool demand and price growth in the services sector.

According to Fed Chair Powell, this is likely to materialise in the shelter (rent) category by mid-year and then the broader s

The continued downward trend in monthly inflation will therefore be heavily dependent on the Services sector which still has some way to go to reach pre-pandemic levels.

Positive for now is Chair Powell is showing some willingness to be patient. The caveat is the US Fed will look at incoming data and adjust their policies to ensure their 2% annual inflation target is achieved.

THE GROWTH OUTLOOK IS HOLDING UP

In October investors were concerned about the outlook for global economic growth mostly due to an aggressive interest rate hiking cycle globally.

Fuelling concerns were job layoffs in the US tech sector, Europe entering winter with energy supply challenges, and ongoing China pandemic lockdowns.

Today we are closer to the end of rate hikes, US tech job cuts have not spread to other sectors, Europe had a mild winter with ample gas supplies, and China is reopening sooner and faster than expected.

Fuelling the “strong economic momentum” narrative has been extremely robust US jobs reports. The December jobs report showed 223,000 jobs added vs 200,000 expected kicking off a strong market rally.

The January report saw 517,000 jobs added whilst economists expected 185,000.

These strong employment reports contributed to the easing of growth concerns amongst the bears.

HAS ALL THE GOOD NEWS BEEN PRICED IN?

The easing of bearish sentiment has aided the recent equity market rally, but can bullish sentiment now improve to drive a lasting bull market?

Key to a lasting bull market is the bottoming and improvement in corporate profit expectations. This is not something we are seeing just yet.

Below in red are the historical earnings of the US S&P500 Index. The current reporting season has seen earnings growth come to a standstill at the index level.

Earnings expectations for 2023 have also been downgraded from $248 in April 2022 to the current $221.

We will likely need to see a reversal in the earnings trend to get the bulls excited. Without earnings growth, any market strength will merely be investors paying a higher price for the same earnings.

Current 10-year bond yields would have us expect to pay in the region of 17 times US S&P500 earnings.

Investors are today willing to pay a +5-10% premium to own US equities despite 2023 earnings being under pressure.

AUSTRALIAN EQUITIES

The S&P/ASX200 Index gave back -2.45% in February after trading less than 1% off its August 2021 all-time highs. This is quite remarkable given the challenges of the last 12-months.

The weakness was seen in Index heavy sectors with Materials declining -6.90% and Financials declining

-3.83%.

After a strong run on the China reopening news investors took some money off the table seeing BHP and Rio Tinto down -8.42% and -7.81% respectively.

In the Financial sector Commonwealth Bank posted a record half year profit of $5.15B but still lost -8.54% of its market value. Investors are weighing up whether future earnings reports can beat the one just delivered.

Leading from the front were the defensive sectors, Utilities +2.28%, Consumer Staples +0.90% and Communications +0.41%.

The Technology sector managed to close the month out with a +2.24% gain. The sector has largely traded sideways for the last 10-months after declining just over -30% from its 2021 highs.

INTERNATIONAL EQUITIES

The MSCI All World Index ended the month -2.40% lower seeing the 12-month drawdown at -7.33%.

The risk off mood was evident across all markets confirming the waning risk appetite for equity investments.

The S&P Europe350 Index weakened -0.75%, the US S&P500 Index weakened -2.44%, and the S&P Japan500 Index weakened -3.55%.

Emerging markets underperformed developed markets with the Dow Jones Emerging Market Index ending the month -5.72% lower.

Investor optimism from a China reopening quickly faded with the S&P China500 index weakening -7.46% after gaining +11.44% in January.

PROPERTY AND INFRASTRUCTURE

The Australian Property Index weakened -0.26% in February significantly outperforming Global Listed Property (Hedged) which gave back -4.66%.

Global Listed Infrastructure (Hedged) got caught up in the risk off mood ending the month -1.94% weaker despite of all its defensive characteristics.

FIXED INCOME

The Bloomberg Australian Bond Index gave back -1.32% over the month but is still +0.85% above the Oct22 lows.

The 10-year Australian government bond yield closed the month slightly higher at +3.89%. To us Government bonds appear attractive around these yields.

GENERAL ADVICE WARNING

The advice contained within this document does not consider any person’s particular objectives, needs or financial situation. Before making a decision regarding the acquisition or disposal of a Financial Product, persons should assess whether the advice is appropriate to their objectives, needs or financial situation. Persons may wish to make their assessment themselves or seek the help of an adviser. No responsibility is taken for persons acting on the information within this document. Persons doing so, do so at their own risk. Before acquiring a financial product, a person should obtain a Product Disclosure Statement (PDS) relating to that product and consider the contents of the PDS before making a decision about whether to acquire the product.