Monthly Investment Update — April 2023

APRIL 2023

This month’s newsletter looks at some of the key issues facing markets and recent asset class performance.

The main points are as follows:

The current investment picture is complicated by conflicting messages from equity and bond markets.

Equity markets are saying robust economic growth can continue underpinning a strong recovery in US earnings.

Bond markets are saying the US economy is on the cusp of a significant downturn.

Bond markets have priced in a US Fed ‘pivot’ and interest rate cuts starting from September.

We don’t know for certain which outcome will eventuate but lean towards what the bond market is saying.

History is a good guide and shows that aggressive interest rate tightening cycles are not consequence free. The recent US banking failures are a testament.

Most important for equity market investors is that stocks are priced for positive outcomes so there is only marginal reward on offer for risk taken.

Global equity markets had a mixed performance in March.

Growth-orientated regions such as the US with higher Index weightings in technology stocks benefitted from lower bond yields (future earnings worth more).

Economically sensitive regions such as Australia with a high concentration of financial stocks underperformed. Conflicting messages from equity and bond markets highlight the current uncertainty facing investors.

Equity markets are saying that the US economy will remain resilient which is supportive of US company earnings. Analysts are forecasting a return to double digit earnings growth in 2023 and 2024.

Bond markets are taking the opposing view saying the peak in inflation and growth may now be in the rear-view mirror. With banking system risks elevated, the US Fed may need to pivot to avoid a significant economic downturn.

US interest rate expectations eased during March. A lower peak and more aggressive rate-cutting path now expected as shown on the right.

The catalyst, realisation that the US banking system cannot tolerate sustainably high interest rates.

The quick succession of bank failures including Silicon Valley Bank and Credit Suisse has undermined confidence and resulted in a tightening of credit (banks less willing to lend). This will have knock-on effects through the US economy and likely expose further points of weakness within the banking system in time.

Who is right? We don’t know for certain but lean towards what the bond market is saying.

Bond investors naturally know more about the economy and banking sector than equity market investors.

History has also repeatedly shown that the US Fed tends to overshoot. Recessions typically follow aggressive rate hiking cycles as shown in the chart below. So sometimes do banking crises. Earnings come under pressure. Rates cuts quickly follow.

To think there will be no serious repercussions this time around appears unrealistic.

With equity markets discounting these risks and priced for strong earnings growth we continue to believe that a cautious and patient approach is sensible. At current levels, the reward for risk-taking is marginal.

The next signpost is US Q1 earnings results starting later this month. We will discuss key findings in May’s newsletter.

WHAT ARE THE SHORT-TERM CONCERNS?

Elevated inflation has resulted in the fastest interest rate hiking cycle in decades.

This is at a time when Governments and households are more indebted than any generation before.

Investors are today concerned about the lagged economic and banking system impact of high interest rates.

As an example, in Australia fixed rate mortgages mask the impact of higher interest rates until fixed rate contracts end.

Is there a tsunami of debt defaults barrelling down on highly indebted Australian households?

Investors are today asking what the impact will be on corporate profits as we travel through 2023.

CONCERNS HAVE SPIKED IN THE US!

The recent challenges facing Silicon Valley Bank (SVB) has caught many investors offside.

The collapse of SVB marks the second largest US bank failure in history which is why it called the US Fed to act swiftly.

What went wrong? The unprecedented response from Governments during the pandemic by lowering rates to 0% sparked a rally in risk assets.

Even Venture Capital (Start-up businesses) funds mostly found in Silicon Valley boomed. Once they received capital from investors, they would park the funds at SVB like everyone else in Silicon Valley did.

As we know, start-up businesses burn through cash and draw down on the capital placed at the bank.

SVB however reinvested the money in bonds and mortgage-backed securities. Unfortunately, inflation arrived, interest rates moved higher, and bond values dropped.

With depositors drawing down on money and the value of the bank’s assets declining the future looked bleak and the Fed had to secure the capital of deposit holders.

The question now remains who else is in a similar situation?

That is a very simple summary. Once again it highlights the stresses faced by businesses built on low interest rate environments.

THE JOB OF THE FED IS GETTING EVEN TOUGHER…

BUT WHAT IS IMPORTANT?

After the fastest rate hiking cycle seen in 4 decades the Fed would think their job is close to being done.

Wrong. The economy remains resilient. Inflation is sticky. The labour market is tight. There are only hopes that the lagged impact will slow things.

The impact of higher interest rates on households and businesses appears to less than anticipated. Chair Powell has acknowledged some structural changes, especially in the labour market.

What does the Fed do now? The SVB debacle will have the Fed questioning the path they are travelling on.

Do they aggressively push ahead in meeting their inflation goal of 2% risking more failures? Or do they take a more cautious approach and risk inflation running higher for longer?

With their credibility at stake the likely path is the former and current path they are on.

Staying the course will however be even tougher as we see “who has been swimming without clothes”.

As long-term investors, most important to us is, at today’s prices are we able to generate appropriate long term returns for risks taken.

ARE WE BEING REWARDED FOR TAKING RISK?

The short answer to this question is yes, but perhaps not enough for outsized returns.

Looking back over the last few decades, one of the greatest levers of wealth creation has been risk taking.

Investing in higher risk equities delivered much greater returns than investing in defensive bonds / cash.

For some investors the reward in equities has however been rather unexciting.

Someone who purchased a US S&P500 Index ETF in Mar00 had to wait 7 years to recover Dotcom losses.

Someone who purchased a US S&P500 Index ETF in Oct07 had to wait 5.5 years to recover GFC losses.

However, the patient investor who added risk when the reward was favourable doubled their money in 5-7 years.

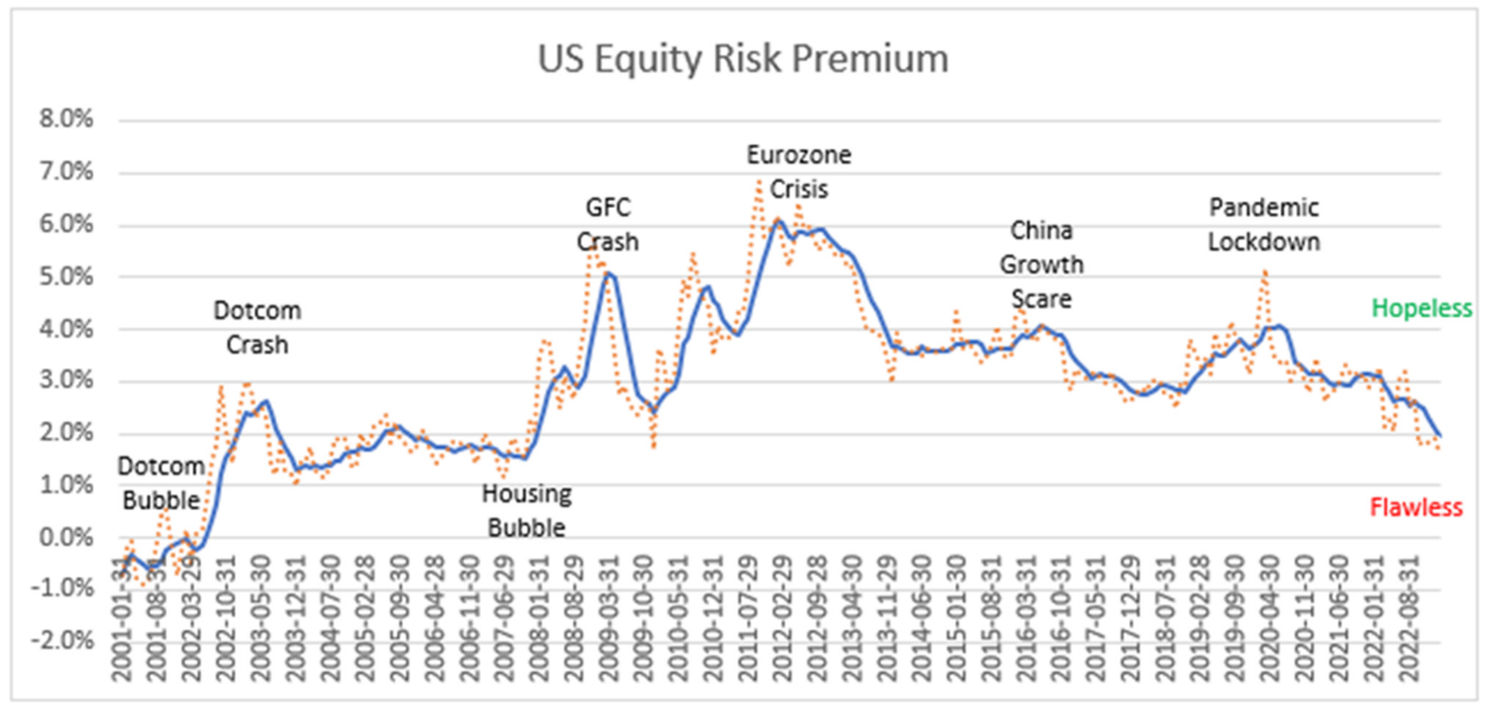

The below chart highlights “the reward”, the premium investors earn when owning equities over bonds.

The premium for owning equities is today the lowest it has been since the 2008 Global Financial Crisis.

US equities are today back at levels (1.6%) seen during the 2007 US Housing Bubble.

A bubble which came unstuck when the US Fed hiked interest rates to slow the US economy.

We are however nowhere near the valuation insanity seen in the Dotcom Bubble.

A bubble which also came unstuck when the US Fed hiked interest rates.

Yes, equity market prices have come off their Jan22 all-time highs. Bonds however are trading at decade high yields taking the shine off equities.

Howard Marks often refers to market perception swinging between “flawless” and “hopeless”.

In Mar20 investors were in the “Hopeless” camp. In Dec21 they were in the “Flawless” camp.

Where are we today? Somewhere in the middle. What does this mean?

Equity losses are unlikely to take 7 years to recover but neither is risk to be rewarded with outsized returns.

Returns are likely to be mediocre from today’s starting point.

A good mix of risk-free Government bonds and high-quality corporate bonds can return 4% pa and a blended equity portfolio 6% pa (4%+2%).

A 50/50 portfolio return estimate is 5% pa. A 100% equity portfolio is 6% pa and 100% bond portfolio is 4% pa.

We think the reward for risk taking is marginal.

AUSTRALIAN EQUITIES

The S&P/ASX200 Index ended March slightly lower losing -0.16% but well off its intra-month low. The 12-month return is a very respectable +0.10%, compared to losses on most other developed markets.

Sector performance echoed offshore movements with the Financials sector declining -5.08% and the Property sector -6.93%. Investor sentiment towards banks and property companies soured after the recent US banking failures.

The Energy sector declined -4.85%. Oil prices having now declined for 9 of the past 10 months.

The Materials sector bucked the trend gaining +4.08%. Consolidation of the iron ore price above US$120/t is positive for the profits of mining giants BHP, Rio Tinto and Fortescue.

INTERNATIONAL EQUITIES

The MSCI All World Index rebounded +3.09% taking the 12-month drawdown to -7.02%.

Among US markets, the Nasdaq Index outperformed gaining +6.78% as technology stocks benefitted most from cooling interest rate expectations.

The S&P 500 Index added +3.67% and the Dow Jones Industrials Average gained +2.63%.

The S&P Europe 350 Index gained +2.67% lifting the 12-month return into positive territory. The S&P Japan500 Index rallied +4.45%.

Emerging markets delivered more modest returns with the Dow Jones Emerging Market Index ending the month +1.88% higher.

The S&P China500 index gained +1.80%.

PROPERTY AND INFRASTRUCTURE

Property’s slide continued in March. The Australian Property Index slumped -6.79% and Global Listed Property (Hedged) eased -2.84%.

Confidence in Australian commercial property hit by reports that a major industry superannuation fund had pulled properties for sale after receiving bids significantly below book value.

Global Listed Infrastructure (Hedged) faired better ending the month +1.86% higher.

FIXED INCOME

The Bloomberg Australian Bond Index gained +2.85% in March supported by declining global bond yields as inflation expectations eased.

The 10-year Australian government bond yield ended the month at 3.30%, a big fall from 3.85% at the end of February. Bond investors have quickly replaced inflation concerns with growth concerns.

GENERAL ADVICE WARNING

The advice contained within this document does not consider any person’s particular objectives, needs or financial situation. Before making a decision regarding the acquisition or disposal of a Financial Product, persons should assess whether the advice is appropriate to their objectives, needs or financial situation. Persons may wish to make their assessment themselves or seek the help of an adviser. No responsibility is taken for persons acting on the information within this document. Persons doing so, do so at their own risk. Before acquiring a financial product, a person should obtain a Product Disclosure Statement (PDS) relating to that product and consider the contents of the PDS before making a decision about whether to acquire the product.