Monthly Market Update — July 2021

This month’s newsletter looks at “reflation” and “inflation” in more detail and explores what investors can do to navigate the current higher inflation data.

The main points are as follows:

Booming global economies with continued support measures could create inflation headaches for Central Bankers.

Investors are now joining Central Bankers believing inflation will only be temporary. This is seeing a broad rally across asset prices.

Things can however get messy should inflation prove to be stickier. Now is a good time to consider how portfolios perform in that environment.

Easing COVID-19 restrictions are driving continued strength in the global economy. For the first time since the pandemic began, growth in the service sector is now outpacing growth in the manufacturing sector.

Economic strength is likely to persist for some time. Consumers are optimistic and willing to spend whilst suppliers are at capacity and having to work through backlogs. The pricing power has clearly shifted to suppliers and prices are already moving higher.

Central Bankers are however still relaxed keeping emergency settings such as record low-interest rates in place. Up until now, the prospects of persistently higher inflation are mostly being rejected. Will Central Bankers keep the same view in the coming months as inflation moves higher?

It is with little surprise that the market agrees with the “inflation will be temporary” thesis. This will be the best outcome for equities. Should however inflation prove to be more persistent, then the market outlook becomes more challenging. Higher costs not passed onto consumers will hit corporate profits. Passing higher costs onto consumers will result in inflation and higher interest rates which will hit valuations.

This month’s newsletter is dedicated to the very topical subject of inflation. The old forces driving inflation lower remain well entrenched. But things may be different this time. Massive amounts of stimulus coupled with other Government policies are likely to be more inflationary.

The market is guessing what the world will look like in 12–18 months from now. That outcome is largely dependent on what Central Banks do which is why the actions of the US Federal Reserve Bank is so critical at this stage.

US inflation reaches +5%. Is it Transitory?

For months we have been reading (and writing) about the negative side effects of too much stimulus. Surely there must be a limit? At what point does it fail? Too much of a good thing must be bad, right?

The obvious negative outcome is inflation. An increased amount of money chasing the same amount of goods. In fact, it turned out to be an increased amount of money chasing fewer goods and services.

The last year has however seen inflation remain low as economies failed to fully fire up because of restrictions. These restrictions are slowly easing, and higher inflation data is now being recorded.

The world’s largest economy (US) is leading the way. In May we learned April inflation was +4.2% and in June we learned May inflation was +5.0%.

This would have shocked the market 6-months ago. Not today. The market agrees with the US Fed in that “inflation will be transitory”. Elevated in the short term but fall back to around +2% into 2022.

The weakness in bond yields and strength in high growth stocks tells us one thing. There are a growing number of economists and analysts that have now joined the “inflation will be transitory” storyline. US Fed Chair, Jerome Powell would be ecstatic about this.

More and more investors are abandoning their inflation protection and positioning for “transitory inflation”. This could see share markets caught offside should inflation prove to be sticky.

The RECOVERY went as planned!

The last 15 months has seen massive amounts of Government spending coupled with record low-interest rates. This response to the pandemic has seen double-digit economic growth in several major economies.

The vaccine announcement in November 2020 was critical for a sustained economic recovery. This coupled with record stimulus and low-interest rates provided the perfect mix for a strong economic reopening.

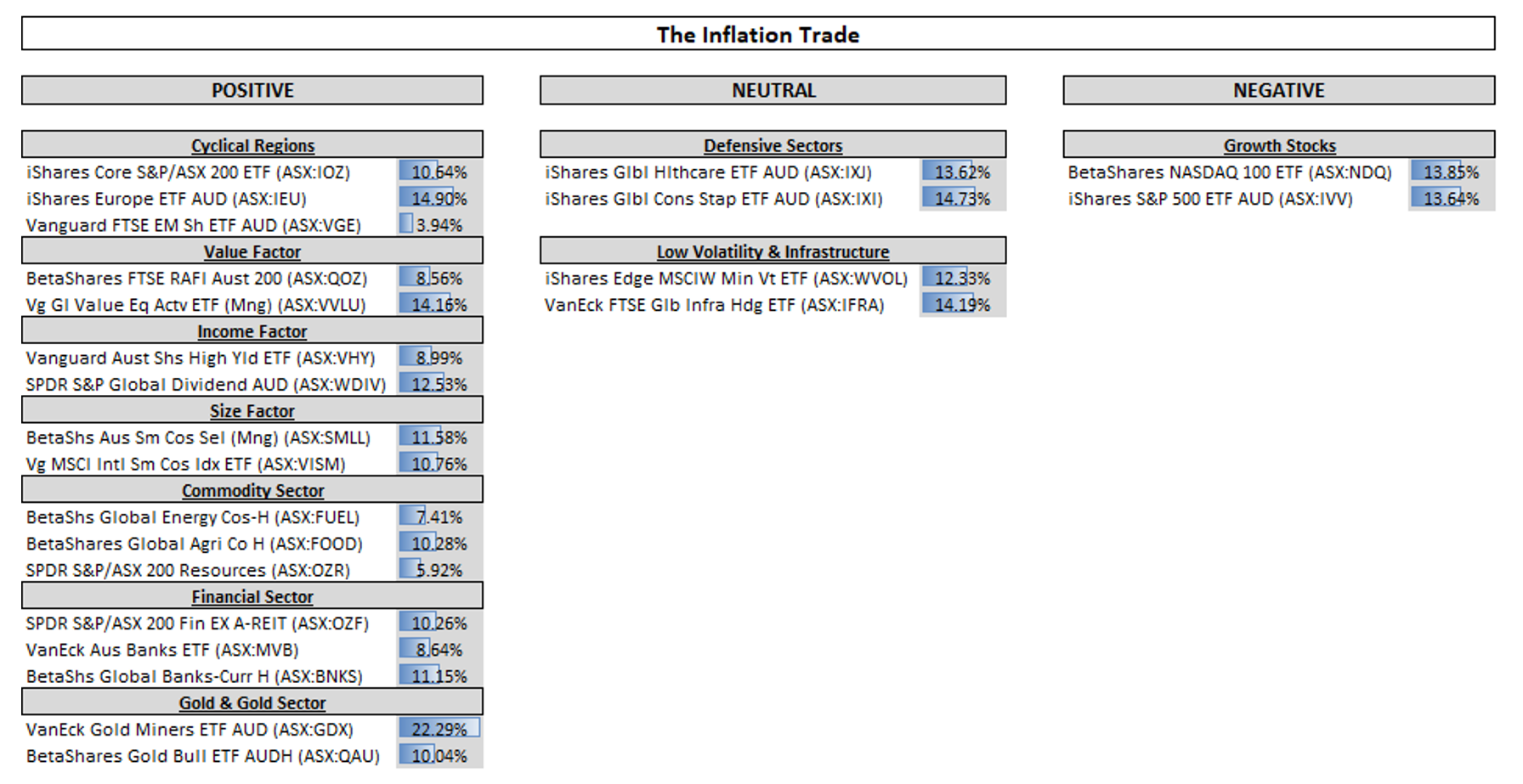

Financial jargon for this stimulus-induced economic recovery is “reflation”. Share markets responded as we expected. The below table highlights our most preferred and least preferred ETFs for the reflation trade together with their respective returns since the November Pfizer vaccine announcement.

From the above, the winners are those regions, sectors and businesses who benefit most from a growing economy. Banks write more loans in boom times, whilst Supermarket’s sales growth remains more muted.

After 7 months we are now considering whether the Reflation trade has more room to run. This cannot go on forever, so we need to consider where to from here?

Investors are not worried about inflation. Should you be?

As expected, a strong economy should see higher share markets. What can change this? Weaker economic growth or higher inflation. Let us have a look at recent equity market performance to see what investors think about the outlook for inflation.

We use the latest stimulus announcement by US President Biden in March as catalyst for the “inflation trade”. Was the latest stimulus package enough to tip the scales in favour of “inflation”?

We do not think so. There is no clear outperformance of inflation hedges as we would expect in an inflationary environment (left-hand column). Everything has done well! More recently the disinflation stocks (right-hand column) have performed best.

This is partly reflective of policy settings still being extremely supportive of the economy and share markets. It is worth noting that there is however increasing talk about reducing the amount of support. Whilst not overly negative, it should create increasing volatility over the coming months.

What does this tell us? More and more investors are taking the view that inflation will be temporary. Whilst this is good for share markets, things can get messy if inflation proves to not be temporary.

The bottom line, if you do not know where inflation is heading, make sure your portfolio is constructed in such a way that it does not look like you do know (ie. diversify).

Australian Equities

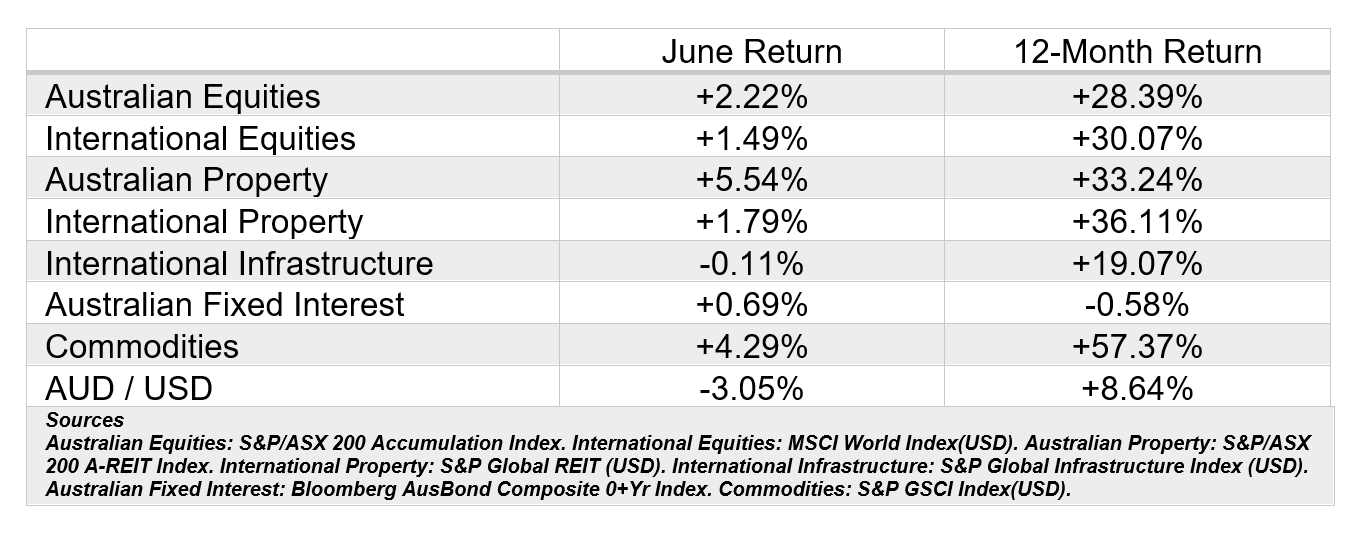

The S&P/ASX200 Index posted a +2.22% return for the month of June resulting in a +28.39% return over the last 12-months.

Top-performing sector was the Technology sector gaining +13.39% in June recovering the -9.86% decline of the prior month. The strength mostly due to the pause in the reflation trade which has seen strength in high growth stocks.

Defensive sectors were also in favour over the month with the Communications and Staples sectors gaining +5.55% and +5.32% respectively. The strength in the Communications sector driven by Telstra which was up +6.80% in June after announcing tower asset selldowns which eased dividend concerns.

Financials was the only sector to record a negative return for month declining -0.19%. Not surprising after the recent strength seen in this sector.

International equities

The MSCI All World Index gained +1.49% for the month of June, gaining +30.07% over the year marginally outperforming the local benchmark.

Regional performances were mixed with a clear reversal between recent winners and losers. Best performing regional market was the technology-heavy US S&P500 Index which gained +2.33% over the month.

Economically sensitive markets experienced some headwinds with the S&P Japan500 Index gaining a more muted +0.40% whilst the S&P Europe350 Index retreated -1.45%

The S&P Dow Jones Emerging Market Index was largely flat over the month gaining +0.03% as COVID-19 outbreaks continue to present greater challenges in emerging economies.

Property and Infrastructure

Australian Property Index posted a +5.54% gain for the month of June. Hedged Global Listed Property gained +1.79%, outperforming Australian Property by +2.87% over a 12-month period.

Hedged Global Listed Infrastructure ended the month largely flat at -0.11%, still gaining +19.07% over the last 12-months.

Fixed income

The Bloomberg Australian Bond Index gained +0.69% over the month recovering much of the weakness from earlier in the year.

The 10-year Australian government bond yield is weaker, currently paying investors +1.49% per annum whilst the RBA cash rate remains at +0.10%.

GENERAL ADVICE WARNING

The advice contained within this document does not consider any person’s particular objectives, needs or financial situation. Before making a decision regarding the acquisition or disposal of a Financial Product, persons should assess whether the advice is appropriate to their objectives, needs or financial situation. Persons may wish to make their assessment themselves or seek the help of an adviser. No responsibility is taken for persons acting on the information within this document. Persons doing so, do so at their own risk. Before acquiring a financial product, a person should obtain a Product Disclosure Statement (PDS) relating to that product and consider the contents of the PDS before making a decision about whether to acquire the product.