Monthly Investment Update — December 2022

In our final newsletter of the year, we look at the factors driving the recent equity market rally and unpack the key investment considerations for 2023.

The main points are as follows:

US inflation has likely peaked, which should see the current aggressive interest rate hiking path ease in 2023.

Inflation data is however not yet the compelling evidence the US Fed needs to say its job is done.

The US Fed is likely to keep interest rates elevated.

This will be good in bringing inflation down but will be bad for the economy and earnings growth.

The US Fed has a history of keeping interest rates too high for too long and delivering a recession.

The US Fed views a weaker economy to be a less bad outcome than persistent inflation.

Investors now need to remain focused on the impact of recent rate hikes on corporate earnings.

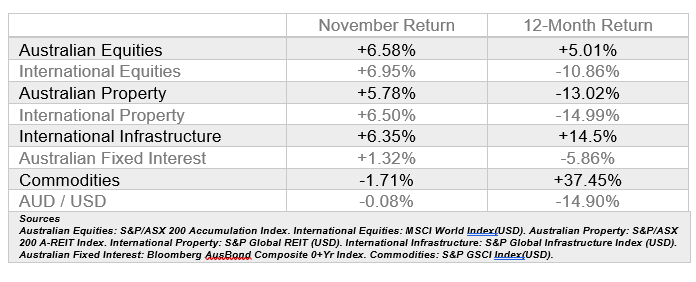

Share markets continued to move higher through the month of November. The US S&P500 Index gained +5.59% and the ASX200 index gained +6.58%.

Investors are cheering that interest rate hikes may soon slow. This view was confirmed by US Federal Reserve Bank Chairman, Jerome Powell. “The time for moderating the pace of rate increases may come as soon as the December meeting.” This is welcome news for the bulls who have had very little good news from Central bankers in 2022.

The bears are unlikely to give up without a fight. Market volatility is therefore likely to continue as we move through the early part of 2023. The debate remains whether the market direction in 2023 will look more like 2022 or 2021.

The challenge the bulls face in the next year is that the interest rate hikes are merely slowing, perhaps peaking in the first half of the year. History tells us the bulls only regain control when interest rates have peaked, interest rates are being cut, and economic growth improves. At this stage we side with history.

For now, good news is good news and share markets are responding accordingly. During the June and October lows investors had to navigate a future of higher interest rates and a weakening economic outlook. Today the bulls are arguing that the interest rate outlook has improved, and the subsequent economic challenges are lessened.

Time will prove whether their assumption is correct. Our view is the bulls may be getting ahead of themselves. There is a difference between “moderating the pace of rate increases” and interest rates cuts. With interest rates expected to remain elevated for some time we would expect corporate profits to face some challenges in 2023.

In our view current market pricing is optimistic about corporate profits in 12-months’ time. These bullish forecasts hinge on inflation declining in the coming months and Central bankers cutting interest rates in the second half of 2023. Jerome Powell is more cautious in concluding inflation will decline rapidly and warned against such assumptions.

Today’s share market pricing is likely to deliver only modest returns over the next few years. This limited reward has us asking whether it is worth taking the risk. Soon we will know where inflation settles. We will also know where interest rates settle. We will then know the outlook for corporate profits. Bull markets are built on certainty and last much longer than bear markets.

Today investors are being rewarded in defensive investments such as bonds, term deposits and cash accounts. As mentioned earlier, interest rate expectations are peaking which is good news for fixed rate bond investors.

Peak inflation? Now what?

INFLATION HAS LIKELY PEAKED

The last 12-months have been all about multi decade high inflation and the actions from Central Banks.

It now seems likely that inflation has peaked, and Central bankers are talking about slowing the pace of interest rate hikes.

We would have to arrive at this point at some time as higher interest rates start to slow demand.

US inflation increased at 7.7% over 12-months ending October vs 7.9% expected and 8.2% in September.

The response from markets was a meaningful relief rally in just about every asset class.

As we know the US Fed remains focused at bringing inflation back down to pre-pandemic levels (2%).

For now, the direction is encouraging but it is unlikely to be the compelling evidence the US Fed is looking for to say its job is done.

WILL THE LIST OF SPOT FIRES SOON PEAK?

The path of higher interest rates has sparked spot fires all over the global economy and financial system.

A strong US$ has seen currencies under pressure, calling for Central Bank intervention, especially in Japan.

Higher bond yields have resulted in forced bond selling within pension funds, especially in the UK.

These two markets are perceived “defensive” but proved to not be when interest rates rose rapidly.

The last month has seen another low interest rate beneficiary face disaster, crypto exchange FTX.

None of these spot fires have resulted in a larger fire, pushing the broader financial system into failure.

To date, Central Bankers have successfully deflated the pandemic asset bubble.

Yes, bonds with low yields, speculative crypto assets, unprofitable companies have been punished.

Companies with real profits have had a much better outcome in 2022.

The below chart shows what $100 invested in September last year is worth today.

Best performing is value investor Warren Buffett’s Berkshire Hathaway (BRK)

Worst performing is crypto token FTX (FTT)

Second worst performing is Innovation Investor Cathy Wood’s Ark innovation Fund (ARK)

The perceived defensive UK 20-year bond and Japanese Yen down more than -20%.

Interesting is the best-performing Berkshire does not pay a dividend to shareholders.

The value for investors is the profits the conglomerates’ businesses generate and the compounding thereof.

There is, however one risk to Berkshire’s profits in 2023. Demand destruction from higher interest rates.

Will Central Bankers go too far in the coming months? We think so.

CENTRAL BANKERS DON'T HAVE HISTORY ON THEIR SIDE

The US economy is slowing. If the US Fed stops hiking rates today, we are likely to still see a US recession.

The impact of interest rates on economic activity is nothing new.

Sadly, the likelihood of Central bankers going too far is nothing new either.

The reason is interest rates are set on incoming data, but the impact of rate hikes often lags by 6-months.

Let us take a look at previous US interest rate hiking cycles and the performance of the stock market.

The blue line is US interest rates. The orange bars are stock market performances in the next 6-months.

With inflation easing and Central Banks soon to slow rate hikes, what should we expect?

Many commentators are calling for stocks to rally, we however remain more cautious.

We can see in the above chart that when interest rates peak and stay elevated stocks underperform.

Share markets more often than not moved lower in the months following the peak in interest rates.

One key exception is 1974 when stocks declined -47% over 22-months whilst interest rates moved higher.

The 1996 outcome is what is preferred today but will be challenging with much higher debt levels today.

LET'S NOT IGNORE THE HEADWINDS

Profit headwinds have in the past revealed vulnerable companies.

The best way to illustrate this is the words of the Chairman of Berkshire Hathaway, Warren Buffett.

“It's only when the tide goes out that you learn who has been swimming naked”.

He has made some of the best corporate deals for his shareholders when the tide has gone out.

He provides rescue funding at a cost. Other rescue financiers include JP Morgan and the US Fed.

We are yet to see a deal in 2022. Not even the rock bottom crypto assets have seen any of them step in.

The US Fed stepped in in 2015, 2018, and 2020 when markets declined -9%, -14%, and -14%.

The US Fed, Berkshire and JP Morgan stepped in in 2008/09 when markets declined -51% over 17-months.

The hot air is out, and valuations are better as evidenced by Berkshire’s purchase of semiconductor stocks.

Will the next 12-months however bring the “Elephant Sized” transaction Berkshire is looking for?

AUSTRALIAN EQUITIES

The S&P/ASX200 Index gained +6.58% in November which is a strong follow on from the +6.04% gain in October. Australian Equities continue to outperform International Equities over a 12-month timeframe.

All the 11 ASX sectors ended the month in the green. Leading from the front was the defensive Utilities sector gaining +20.85% and the economically sensitive Material sector gaining +16.23%.

The strength in the Utilities sector is partly owing to the +41.1% gain in the Origin share price after a takeover bid from US investment giant EIG Partners.

The strength in the Materials sector came on the back of improving sentiment toward China growth and the easing of zero-Covid policies.

INTERNATIONAL EQUITIES

The MSCI All World Index ended the month +6.95% higher seeing the 12-month drawdown at –10.86%.

Regional leadership came from Europe. This is largely owning to an improved US/Global interest rate outlook with another positive contributor being better than expected economic data out of Germany.

The S&P Europe350 Index gained +11.91%, the S&P Japan500 Index gained +9.69%, and the US S&P500 Index gained +5.59%.

Emerging markets outperformed developed markets as risk seeking investors sent the DJ Emerging Market Index +13.31% higher. The S&P China500 index gained +18.21% over the month.

PROPERTY AND INFRASTRUCTURE

The Australian Property Index gained +5.78% in November marginally underperforming Global Listed Property (Hedged) which gained +6.50%.

The Australian and Global property indices offer investors income yields of +4.45% and +4.15% which become increasing attractive as interest rate expectations decline.

Global Listed Infrastructure (Hedged) gained +6.35% and remains the best performing asset class over the last 12-months.

FIXED INCOME

The Bloomberg Australian Bond Index gained +1.32% over the month. News flow about slowing interest rate hikes is positive for fixed rate bonds and continues to signal a turning point for this asset class.

The 10-year Australian government bond yield closed the month at +3.56%. To us Government bonds still appear attractive around these yields.

GENERAL ADVICE WARNING

The advice contained within this document does not consider any person’s particular objectives, needs or financial situation. Before making a decision regarding the acquisition or disposal of a Financial Product, persons should assess whether the advice is appropriate to their objectives, needs or financial situation. Persons may wish to make their assessment themselves or seek the help of an adviser. No responsibility is taken for persons acting on the information within this document. Persons doing so, do so at their own risk. Before acquiring a financial product, a person should obtain a Product Disclosure Statement (PDS) relating to that product and consider the contents of the PDS before making a decision about whether to acquire the product.