Investment and Investment Strategies

There are numerous ways to invest across the different asset classes and investment types. This guide provides information on some of the main ways to invest, investment types and strategies.

Once you and your adviser have determined your attitude to investing, risk tolerance and investment profile, it’s time to consider the choice of appropriate investment assets and the structures to hold those assets in.

Managed Funds

A managed fund is a managed investment scheme, open to a wide pool of potential investors. The underlying assets of Managed Fund investments can be either diversified - made up of Australian and international shares, property and fixed interest investments – or sector specific, focusing on a particular asset class such as shares or commercial property.

In a managed fund, your money is pooled together with that of other investors. An investment manager then buys and sells shares or other assets on your behalf. The returns of the fund and the tax treatment of the fund are determined at the pooled level and apportioned to the investors.

You are usually paid income or distributions periodically. The value of your investment will rise or fall with the value of the underlying assets and the unit price of the fund is usually calculated daily.

The investment manager may be called a 'fund manager' or 'responsible entity'.

The benefits of investing in managed funds are:

Access to a broad range of assets or markets with a relatively small amount of cash

Ability to progressively increase your investment by regular or periodic additions

Reduce paperwork and make completing your tax return easier.

The risks of investing in managed funds are:

You may be charged higher fees than other investment types, though fees vary widely (for example, exchange-traded funds often have lower fees than traditional managed funds)

You may not be able to convert your investment to cash at any time.

You rely on the skills of other people and do not control investment decisions.

Direct Shares

Australian direct shares are investments where you have equity (part ownership) in a company listed on the

Australian Securities Exchange. You have purchased rights to participate in the growth and profitability of a company and as a result receive dividends, voting and other rights. Returns on the investment are in the form of increases in the share price, known as capital growth and income in the form of dividends.

Shares can be bought and sold daily, often at differing prices. As such the value of a share can change daily. Share prices can rise as a result of improved company earnings and can fall as a result of negative investor sentiment.

The benefits of investing in shares are:

Potential capital gains from owning an asset that can grow in value over time

Potential income from dividends

Lower tax rates on long-term capital gains

Shares have historically outperformed other asset classes over the long term and can provide a growing income stream.

The risks of investing in shares are:

Share prices for a company can fall dramatically, even to zero

If the company goes broke, you are the last in line to be paid, so you may not get your money back

The value of your shares will go up and down from day to day, and the dividend may vary.

Exchange-Traded Funds

An Exchange Traded Fund (ETF) is a type of investment fund that can be bought and sold on the Australian Securities Exchange. In Australia, ordinary ETFs are usually 'passive' investments that track an asset or market index (for example, the ASX200 Australian share index). They generally do not try to outperform the market and will go up or down in value in line with the index they are tracking. An ‘active ETF’ is when the fund manager is actively trying to outperform the market or index to achieve a different investment objective.

While ETFs may have lower fees compared with other managed investments, management fees can vary and may be higher than the fees of an equivalent unlisted or unquoted index fund.

You will also pay brokerage fees when you buy or sell ETF units. If you want to make a small regular investment in a product that tracks an index, you might be better off using an unlisted managed investment such as an index fund where broker fees won't apply to each contribution, although other fees may apply.

Fixed Interest Investments

Fixed interest investments, like Australian government bonds, can play an important role in a diversified portfolio due to their potential for a low risk, regular interest income, greater diversification, reduced liquidity, potential tax exemptions and capital preservation. Generally these investments are characterised by a fixed income amount or coupon rate and a term or expiry date just like a term deposit. Government or companies can offer these investments.

Investment Bonds

Investment Bonds, often called ‘insurance bonds’, are life insurance products with a savings component. They operate similarly to a managed fund (unit trust). There are different taxation implications as the taxation is payable at the life company level. Earnings within insurance bonds are taxed at the company tax rate and provided there are no withdrawals, it does not need to be reported on the investor’s tax return. On redemption after 10 years, the investment is received tax free. This makes investment bonds a tax effective investment for high income earners or an effective savings vehicle for minors.

Tax payable on Investment Bonds for early withdrawals:

Property

There are a number of ways you can invest into property:

Directly

As an asset in a managed fund (see above)

Property Trust (listed or unlisted)

Property Syndicate.

Direct Property

Direct property involves purchasing a specific property asset. It requires either a large sum of cash to purchase the property and own it outright, or borrowing some or all of the purchase price. For more information on buying and selling direct property refer to the ASIC MoneySmart website.

Property Trusts

To achieve diversification (investment in a range of assets) and reduce the investment threshold required to buy property, many investors gain property exposure via a Property Trust. Depending on the type of property fund you invest in, you might get a regular income (distributions), usually quarterly or half-yearly, and a capital gain on your original investment, if the value of the scheme's underlying investment assets increases.

A property trust is a trust fund, managed by an investment manager who invests in a range of properties which may include residential, industrial, office buildings, shopping centres, hotels and other specialist properties. Income is generated by the assets of the trust and unit values will reflect the value of the trust assets. Some property trusts are listed on the ASX and can be traded on the share market, while others are unlisted. Unlisted trusts may place restrictions on the time it takes to redeem your investment.

Property Syndicates

A Property Syndicate is an investment where investors buy 'units' in an investment usually operated by a professional investment manager. The syndicate's money is invested in property assets which may include commercial, retail, industrial or other property sector assets. Some property syndicates invest in property development, which means there are extra construction and development risks.

The investment manager selects and buys investment properties and is responsible for maintenance, administration, rental collection and improvements to the properties. The money usually stays in the property syndicate until it ends, when the properties are sold and the net proceeds are distributed to investors. You may be able to withdraw your money early but there may be penalties. If the scheme is listed, you may be able to sell your units on the public market.

Cash and Terms Deposits

Cash generally earns very little interest but can be backed by the government guarantee meaning it is a relatively safe investment.

Term deposits are the most familiar type of investments paying interest. They are a savings product from a bank, credit union or building society. Your money is invested for a fixed term and you get a fixed rate of interest over that term.

Ways to Invest and Investment Strategies

Direct or through a Platform

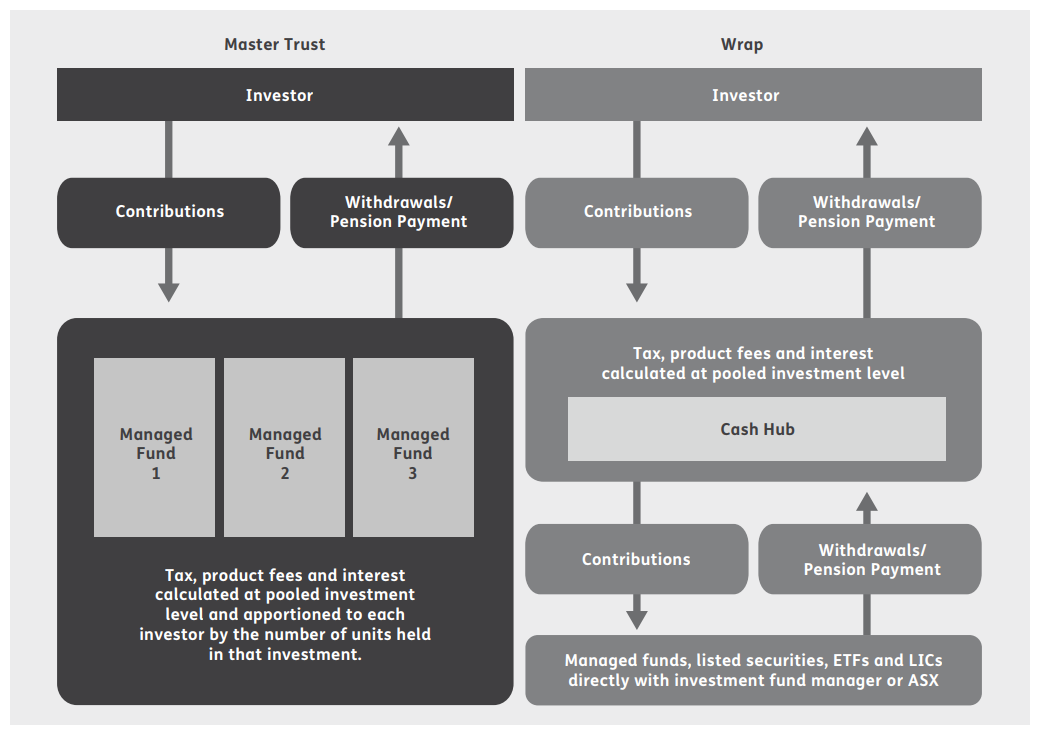

When investing you have a choice of investing directly into an investment/share or through a platform, often called a ‘wrap’. A platform is simply an administration vehicle that holds all of your investments together for ease of reporting, less paperwork, etc.

We generally recommend platforms for clients unless there is a compelling reason to invest directly for the following reasons:

Platforms significantly reduce the complexity of administration burden for a portfolio by providing you with consolidated portfolio reporting including tax records and automated cash flow management

Platforms significantly reduce the complexity of managing your portfolio tax consequences. The platform collects large amounts of investment data and presents it in a single useable tax report, potentially reducing accounting time and costs

Platforms can access investments at wholesale rates that have lower rates than the rates an individual investor can access at a retail level

Platforms allow efficient execution of advice strategies that may save investors time, money and/or tax, as well as help accumulate wealth (If changes were made manually, it would be a lot more expensive and error-prone.).

We may recommend a number of different types of investment structures for your superannuation and investments. The type we recommend will be based on your individual needs.

The below shows the structures of Master Trust and Wrap services.

Investment Strategies

Diversification

To manage the risk of exposure to any one asset or asset class, it is wise to invest in a range of assets. This can be achieved by selecting each individual investment that makes up a portfolio, or by using an investment manager to create the portfolio for you. Diversification can also be achieved by using different investment managers, and by having a mix of Australian and international assets. Diversification is important as some investments do well and others don’t. It’s hard to know what the future holds, let alone the performance of any one specific investment.

Dollar-Cost Averaging

With dollar-cost averaging, you can build assets by setting aside funds at regular intervals regardless of market conditions. Thus you buy assets at different market prices, effectively averaging out the cost of your investment. This reduces the risk associated with fluctuating unit prices and trying to time the most appropriate time to invest.

An example of how ‘Dollar Cost Averaging’ works is shown below:

A capital gain was achieved without the price per unit ever going above the starting price of $100.

Investment Management Styles

Actively managed funds

Actively managed funds are those where the fund manager aims to outperform the market by frequently buying and selling securities that they think are going to do better than others.

Actively managed funds are more expensive as you are paying for the investment skills of the fund manager. Unfortunately actively managed funds rarely consistently outperform the market and any extra profits are often outweighed by extra fees paid to the fund manager.

Actively managed funds are suitable for investors that want to concentrate on certain sections of the market or who want more control over the assets they invest in.

Passive investing

Passive investment funds, also known as index funds, simply buy a portfolio of assets that mimic an index, such as the all ordinaries index or the S&P200 index. Index funds generate a return, before fees, that is almost the same as the index it is tracking (some funds may have timing delays).

Index funds are cheaper as you are not paying for investment expertise.

Investors wanting to invest directly in an index fund have a limited choice of fund managers in Australia, however, some exchange-traded funds are essentially index funds and they have the advantage of being traded on the ASX.

Portfolio Management

Your overall portfolio can also be managed actively or passively.

Actively managed portfolios are monitored generally more frequently. Changes are actively made to the portfolio to rebalance based on market changes. We frequently use a model portfolio that can be rebalanced on your behalf without any paperwork needed.

Passive management - We can also offer passive investing where your portfolio is only reviewed once per annum. We need to make individual recommendations and you must agree to these for them to be implemented.

To find out which investments are right for your situation, speak to your Adviser.

GENERAL ADVICE WARNING

The advice contained within this document does not consider any person’s particular objectives, needs or financial situation. Before making a decision regarding the acquisition or disposal of a Financial Product, persons should assess whether the advice is appropriate to their objectives, needs or financial situation. Persons may wish to make their assessment themselves or seek the help of an adviser. No responsibility is taken for persons acting on the information within this document. Persons doing so, do so at their own risk. Before acquiring a financial product, a person should obtain a Product Disclosure Statement (PDS) relating to that product and consider the contents of the PDS before making a decision about whether to acquire the product.